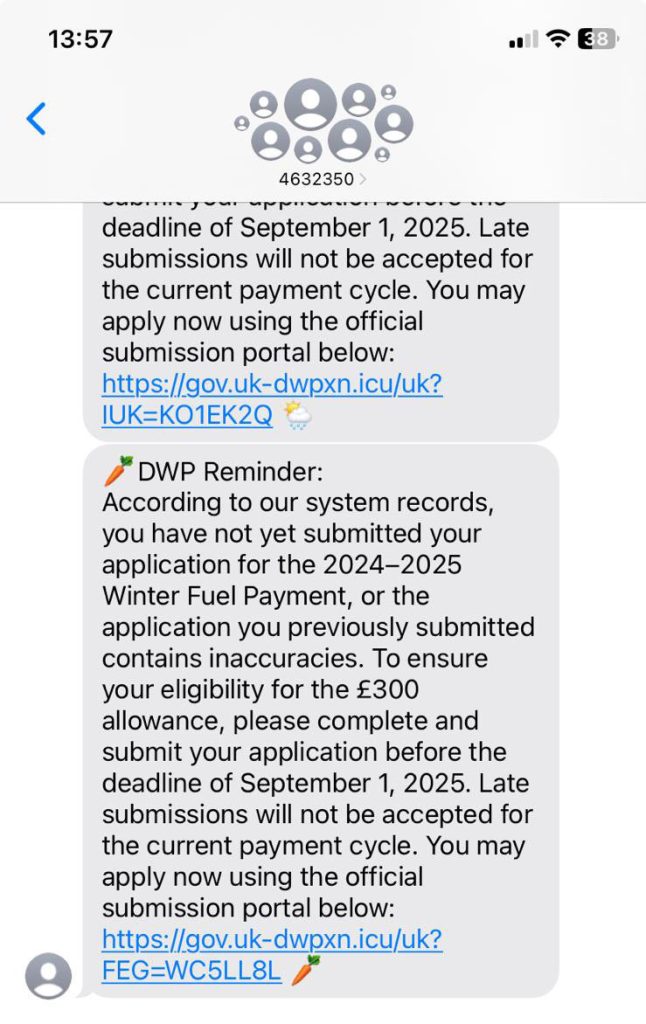

Online scams pose a growing threat to pensioners, who are often targeted because of their savings and limited familiarity with digital risks. Fraudsters exploit trust and vulnerability, using convincing emails, text messages, and phone calls to trick older people into sharing personal details or transferring money. Common scams include fake bank alerts, lottery winnings, investment schemes, and even romance fraud, where criminals build emotional connections before asking for financial help.

The latest online scam

The impact can be devastating. Victims may lose life savings, fall into debt, or suffer from anxiety, shame, and loss of independence. Unlike younger generations, many pensioners live on fixed incomes, making it extremely difficult to recover financially from fraud.

Staying safe requires awareness and caution. Pensioners should be encouraged to double-check messages that seem urgent, never share banking details online, and seek advice from trusted family members or official organisations before making payments. Using strong passwords, installing security software, and learning to recognise suspicious websites are also important steps.

Need Help?

What to Do If You’ve Been Scammed (UK Pensioners):

If you or a loved one have already fallen victim to an online scam, it’s important to act swiftly—but you’re not alone.

Report the scam immediately:

- In England and Wales, contact Action Fraud, the UK’s national fraud and cybercrime reporting centre. You can report online or call 0300 123 2040

- In Scotland, report the crime to Police Scotland by calling 101

Contact your bank or pension provider:

- For unauthorised transactions, notify your bank straight away. Depending on how you paid, you may be entitled to a refund—especially under new rules for bank transfers made on or after 7 October 2024 (refunds possible up to £85,000)

- https://www.citizensadvice.org.uk/consumer/scams/check-if-you-can-get-your-money-back-after-a-scam

Get emotional and practical support:

- Age UK provides specialist advice and support over the phone at 0800 678 1602, open daily from 8 am to 7 pm

- Victim Support, a national charity, offers free and confidential counselling and practical help:

- https://stopthinkfraud.campaign.gov.uk/recovery-from-fraud/get-support-after-fraud/

- In England & Wales: 24/7 support line at 0808 168 9111

- In Scotland: 0800 160 1985 (Mon–Fri, 8 am–8 pm)

Get additional advice and protection:

- Citizens Advice offers guidance on fraud, complaints, and recovery—you can call the consumer helpline at 0808 223 1133

- For pension-focused scams, consider contacting The Pensions Advisory Service (TPAS) for free, impartial help

- If a regulated firm misadvised you, check eligibility for compensation through the Financial Services Compensation Scheme (FSCS)